Make a Donation to CASA

Your Donation Impacts Young Lives

You fund additions to our library for volunteer advocate training. You fund our volunteer advocate travel to visit child victims, school counselors, and court hearings. You fund the supplies and meeting space for our seven-week sessions to train a team of 6-8 new volunteer advocates. You support your local CASA in emergencies and funding shortfalls. We are so grateful for your donations that do so much for our children and community.

Be a Champion for Children

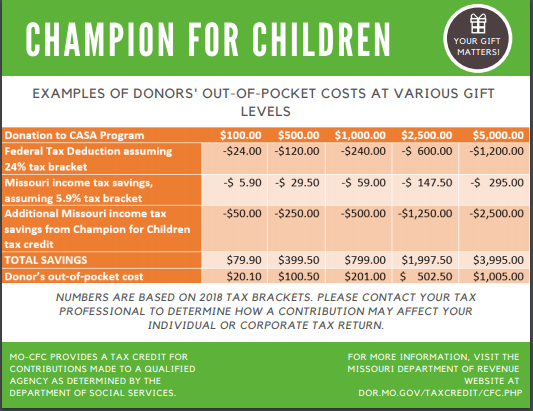

- Champion for Children (“CFC”) Tax Credits are established from the Missouri State legislature and are awarded to only 3 agencies in the state (CASA, Child Advocacy Center, Crisis Care Centers) serving to help organizations that are helping children in crisis. The annual budget recently was raised from $1,000,000 to $1,500,000, equally apportioned between the three. Last tax year approximately 98% of those requesting a CFC tax credit through a donation to CASA received it.

- Unlike a tax deduction, a tax credit can be used regardless if you itemize or not and is taken directly off of your tax burden. For example, if you make $30,000/year and you pay 6% of that in State of MO taxes, this would be $1800 tax due at the end of the year. If you donated $200 to CASA, you qualify for a $100 tax credit (50% of the donation!) to be taken off of your $1800 tax bill. Tax credits can be carried over into the following tax year if one’s tax burden was below the donation amount.

- The donation ALSO qualifies for federal and state deduction if one itemizes.

- Donations have to be over $100 per incidence. For example, a monthly donor of $10 would add up to $120 at the end of the year, but would not qualify since each incidence was under $100.

- At the time of a qualifying CFC donation our CASA agency will send to the donor both a tax receipt letter and the MO-CFC form required to be submitted with their taxes. They are encouraged to consult with their tax professional for additional information.

Thank you

You are making a significant difference in the life of a child.

We appreciate you.

The CASA Staff and Board